Understanding Property Taxes on the Main Line

What Buyers Need to Know in 2026

Summary

One of the biggest pieces of homework for homebuyers on the Main Line — and one of the most misunderstood — is property taxes. In 2026, taxes remain a central factor in affordability, buyer confidence, and total cost of ownership. Unlike mortgage payments, property taxes are real, recurring, and can vary meaningfully from township to township, even within the same school district. For relocators, move-up buyers, and luxury purchasers alike, understanding property taxes isn’t optional — it’s strategic.

In this guide, we’ll break down how property taxes are calculated on the Main Line, how they compare to nearby regions, why they matter for buyers (and sellers), how tax rates interact with school funding, and what you should absolutely check before making an offer in 2026.

Table of Contents

What Property Taxes Pay For

How Property Taxes Are Calculated on the Main Line

How Tax Rates Vary Across Main Line Townships

Property Taxes vs. School Funding

Comparing Taxes: Main Line vs. Bucks & Chester

Relocation Reality: NYC/DC Buyers and Tax Impact

Why Taxes Matter for Long-Term Value

How Buyers Can Estimate Total Carrying Costs

Common Misconceptions About Main Line Property Taxes

Final Takeaways for 2026 Buyers

1. What Property Taxes Pay For

On the Main Line — as in much of southeastern Pennsylvania — property taxes fund critical public services, including:

Public schools

Local police and fire services

Road maintenance and snow removal

Libraries and parks

Emergency services

Municipal operations

In many cases, higher taxes are directly connected to stronger school systems and community amenities. For families seeking stability and excellent schools, this trade-off is frequently worth it — but informed buyers always run the numbers before committing.

2. How Property Taxes Are Calculated on the Main Line

Property taxes are a function of two primary components:

1. Assessed Value

Each township assesses a property’s value, usually based on recent sales, market conditions, and property characteristics.

2. Millage Rate

This is the tax rate set by local governments, expressed in mills (1 mill = $1 in tax for every $1,000 in assessed value).

Example:

If a home is assessed at $800,000 and the combined millage rate is 30 mills, the annual tax bill would be:

($800,000 ÷ 1,000) × 30 = $24,000

Two different homes with the same market value can have very different property tax bills depending on how each municipality assesses value and sets its mill rate.

3. How Tax Rates Vary Across Main Line Townships

The Main Line is not monolithic — every township has its own approach.

Examples of Typical Patterns (2026 context):

Lower Merion Township (Ardmore, Bryn Mawr):

Higher millage rates

Strong public schools

Premium services and infrastructure

Taxes often reflect the high quality of life

Radnor Township (Wayne, Villanova):

Competitive tax rates given service levels

Radnor Township School District is a major driver of value

Tax bills often more tolerable relative to price

Haverford Township (Haverford, parts of Bryn Mawr):

Moderate taxes

Strong community amenities

Schools perform well

Key Point:

You can be two blocks apart and pay materially different taxes — often because of municipal boundaries, school districts, and local budgets.

4. Property Taxes vs. School Funding

Property taxes are often the largest line item in a buyer’s monthly housing cost — especially on the Main Line — because so much of the revenue goes directly into schools.

Higher school spending often translates to:

Lower student–teacher ratios

Better facilities

More extracurricular offerings

Consistently high test scores

This is why homes in Lower Merion, Radnor, and Haverford Township command price premiums: tax dollars are visibly and consistently reinvested into education.

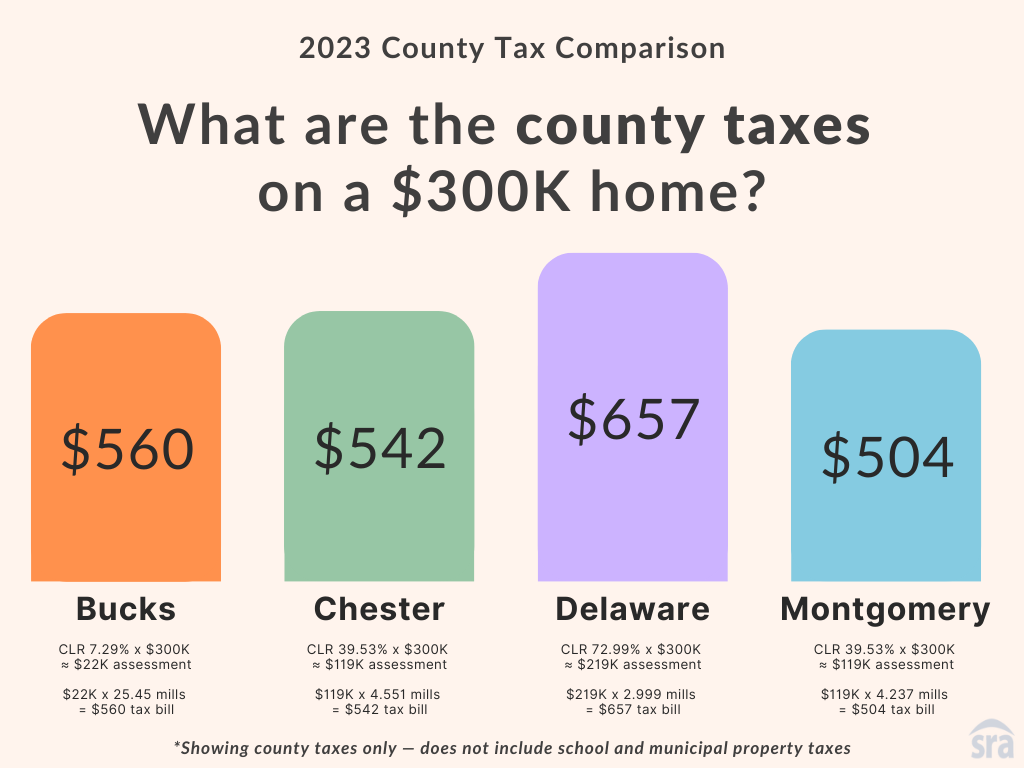

5. Comparing Taxes: Main Line vs. Bucks & Chester Counties

A common question from relocating buyers is:

Are Main Line property taxes higher than in Bucks or Chester County?

The short answer: It depends on the township and the level of services.

In some Bucks County townships (e.g., parts of Newtown and Doylestown), tax rates can be slightly lower — but they may not offer the same intensity of school funding or municipal services.

In Chester County, taxes vary widely by township. Strong school districts like West Chester Area and Great Valley carry tax rates that rival or exceed Main Line townships — but are frequently balanced by larger parcel sizes and lifestyle differences.

Real insight:

You can’t judge affordability by tax rates alone. You need to look at effective property tax burden, which combines tax rate and assessed value.

6. Relocation Reality: NYC/DC Buyers and Tax Impact

Out-of-state buyers relocating from NYC or Washington, DC often discover an important paradox:

Main Line property taxes may be higher than some PA suburban alternatives

But overall monthly housing costs can still be lower than NYC or DC suburbs when mortgage, insurance, and HOA fees are considered

In other words, while taxes are real, the overall affordability landscape can still be favorable — particularly given school quality and lifestyle benefits.

Relocators should:

Run a total monthly carrying cost comparison

Adjust for tax deductions (where applicable)

Evaluate long-term appreciation, not just upfront costs

7. Why Taxes Matter for Long-Term Value

Property taxes aren’t just a cost — they’re part of the value equation.

Communities that consistently fund schools, infrastructure, and services tend to:

Attract longer-term homeowners

Maintain stable demand

Ride out market cycles better

Retain resale value

Tax levels reflect not just a community’s obligations, but also its priorities.

8. How Buyers Can Estimate Total Carrying Costs

When evaluating a property, buyers should always ask for:

Current tax bill

Assessed value and last reassessment date

Millage rates for every applicable jurisdiction

Expected increases based on recent budgets

You can then calculate:

Yearly Tax Bill = (Assessed Value ÷ 1,000) × Total Millage Rate

Next, add:

Mortgage payment

Insurance

HOA fees (if any)

This gives you a true monthly cost, not just a list price.

9. Common Misconceptions About Main Line Property Taxes

“Main Line taxes are out of control.”

Not universally true. Many buyers see higher bills because home values are higher — not because tax rates are absurd.

“Taxes equal worse affordability.”

Only if you ignore school quality and resale stability. A slightly higher tax bill can represent better long-term value.

“PA taxes are lower than NJ forever.”

Not always. Some NJ suburbs near the Main Line (Medford, Moorestown, Cherry Hill) have competitive effective burdens.

10. Final Takeaways for 2026 Buyers

✔ Property taxes are a real cost — but they are only part of the story.

✔ Main Line taxes often buy premium schools, services, and community stability.

✔ Buyers need to calculate total monthly carrying costs, not just taxes.

✔ Relocators should compare tax burden in context (NYC/DC vs. Philly suburbs).

In 2026, the most informed buyers are those who evaluate tax data strategically, not emotionally.

By Eric Kelley, Philadelphia Suburbs Realtor & Attorney