The Real Cost of Waiting:

What Rising Rates vs. Rising Prices Mean for Philly Suburb Buyers in 2026

Summary

Across the Main Line, Chester County, and Bucks County, thousands of would-be buyers are sitting on the sidelines in 2026 waiting for mortgage rates to fall. On the surface, that seems rational. But real estate history — and current local data — tell a different story. When rates fall, competition rises, inventory tightens, and prices usually move higher, often offsetting any monthly payment savings. This article explains why “waiting for rates” has become one of the most expensive strategies in today’s Philadelphia-area housing market.

Table of Contents

Why So Many Philly-Area Buyers Are Still Waiting

What Actually Happens When Rates Decline

The Lock-In Effect and Its Grip on Local Inventory

What Waiting Has Already Cost Buyers (2023–2026)

How This Plays Out on the Main Line

Chester County’s Price vs. Rate Tradeoff

Bucks County and the Supply Crunch

The Real Math of Affordability

How Smart Buyers Are Playing 2026

When Waiting Actually Makes Sense

Bottom Line: Timing the Market vs. Living in It

1. Why So Many Philly-Area Buyers Are Still Waiting

Since mortgage rates surged in 2022, buyer psychology across the Philly suburbs has shifted dramatically. Even households with strong incomes, large down payments, and stable careers have been paralyzed by one thought:

“I’ll buy once rates come back down.”

This thinking is especially common among:

Main Line move-up buyers

New York and New Jersey relocators

First-time buyers in Chester and Bucks Counties

The assumption is that lower rates will mean:

Lower monthly payments

Less competition

Better negotiating power

Unfortunately, that’s not how real estate markets work.

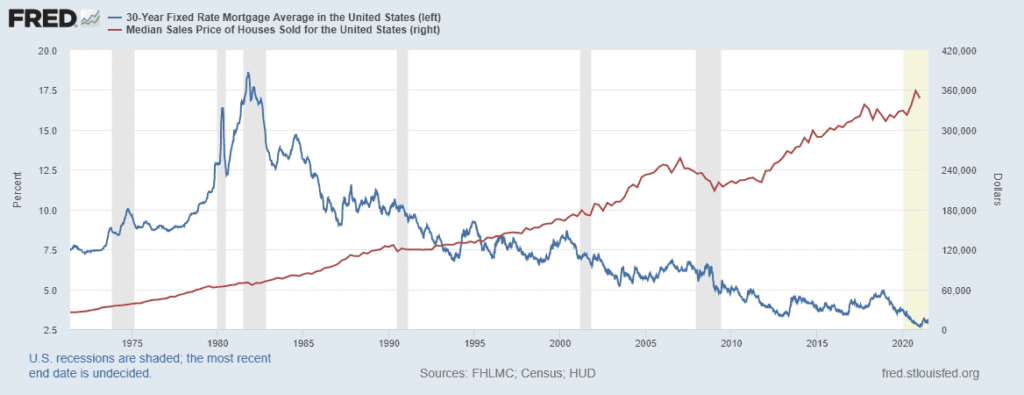

2. What Actually Happens When Rates Decline

Every modern housing cycle tells the same story:

When mortgage rates drop:

Buyer demand jumps

Sellers enter slowly

Competition rises

Prices follow

This happened in:

2012–2013

2019

2020–2021

And it will happen again.

Lower rates do not create cheaper homes. They create more buyers.

3. The Lock-In Effect and Its Grip on Local Inventory

Here’s the problem buyers aren’t factoring in:

Most homeowners in the Philly suburbs are sitting on 2–4% mortgages.

If they sell today:

Their interest rate doubles

Their payment skyrockets

So they don’t sell — unless they have to.

This has created a permanent inventory shortage in:

Lower Merion

Radnor

West Chester

Yardley

Doylestown

That shortage is what keeps prices high — not speculation.

4. What Waiting Has Already Cost Buyers (2023–2026)

Let’s look at a real-world scenario.

A $700,000 home in 2022:

4% rate

~$3,340/month (principal & interest)

That same home in 2026:

Now worth ~$770,000

6.5% rate

~$4,420/month

That buyer is now paying:

$70,000 more in price

About $1,000 more per month

Waiting didn’t protect them — it hurt them.

5. How This Plays Out on the Main Line

The Main Line behaves differently than most markets.

Because:

Buyers are higher-income

Many transactions include large down payments or cash

Inventory is extremely limited

Even when rates rise:

Prices do not collapse

Demand softens slightly

But quality homes still sell

When rates fall, competition returns instantly.

6. Chester County’s Price vs. Rate Tradeoff

Chester County still offers relative value — but even here:

Inventory remains tight

New construction is limited

School districts drive demand

When rates drop, Chester County often becomes the release valve for buyers priced out of the Main Line — pushing prices higher.

7. Bucks County and the Supply Crunch

Bucks County is one of the most supply-constrained markets in the region:

Historic towns

Limited land

Strong New Jersey and New York buyer inflows

When rates drop, Bucks is one of the first markets where bidding wars reappear.

8. The Real Math of Affordability

Affordability is driven by four variables:

Price

Rate

Taxes

Income

You only control one of them: timing.

If rates fall:

Prices rise

Taxes rise

Competition increases

The monthly payment often stays the same — or gets worse.

9. How Smart Buyers Are Playing 2026

The smartest buyers are:

Buying homes that need cosmetic work

Negotiating price and closing costs

Refinancing later when rates fall

They lock in today’s price and tomorrow’s rate.

10. When Waiting Actually Makes Sense

Waiting can make sense if:

You’re relocating soon

You need time to repair credit

You’re saving a down payment

But if you qualify today, waiting is usually expensive.

11. Bottom Line

In the Philly suburbs, history is clear:

Waiting for rates to fall usually means paying more for the same home.

The market doesn’t reward hesitation — it rewards strategy.

If you want a personalized analysis for your budget and target area, that’s exactly what I provide for buyers across the Main Line, Chester County, and Bucks County.

By Eric Kelley, Realtor & Attorney – Serving the Philadelphia Suburbs