Property Taxes in New Jersey Explained:

What Buyers Should Budget For

(and Why They Vary So Much)

Summary

Property taxes are one of the most misunderstood aspects of buying a home in New Jersey. This guide explains how New Jersey property taxes work, why they vary so dramatically, and how buyers should evaluate taxes before making an offer.

Table of Contents

Why New Jersey Property Taxes Are So High

How Property Taxes Are Calculated

Why Taxes Vary So Much Between Towns

School Districts and Tax Burden

Reassessments and Tax Increases

How Taxes Affect Affordability and Resale

Appealing Property Taxes

Common Buyer Mistakes

Final Thoughts

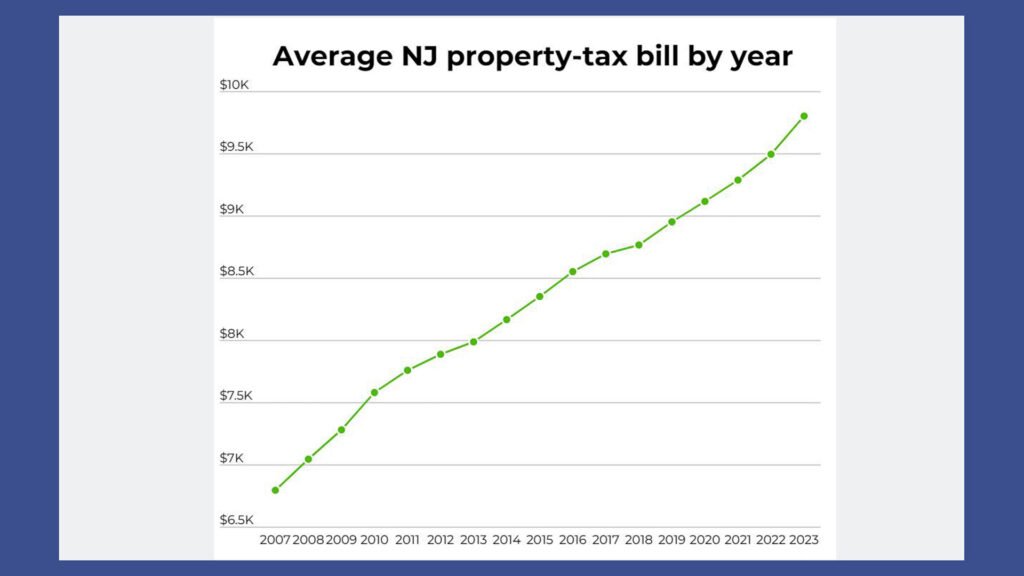

1. Why New Jersey Property Taxes Are So High

New Jersey consistently ranks among the highest-taxed states for property ownership. This is largely due to:

Heavy reliance on local funding

Strong school systems

Limited alternative revenue streams

While high taxes are a drawback, they also fund services that many buyers value.

2. How Property Taxes Are Calculated

Property taxes are determined by:

Assessed value of the home

Local tax rates (county, municipal, school)

Importantly, assessed value is not always the same as market value, especially in towns that reassess infrequently.

3. Why Taxes Vary So Much Between Towns

Two similar homes can have wildly different tax bills depending on:

Township budgets

School district spending

Assessment practices

This is why buyers must evaluate taxes by town, not by county or price range.

4. School Districts and Tax Burden

School funding accounts for a large portion of New Jersey property taxes. Towns with highly rated schools often have higher tax rates — but also stronger resale demand.

Taxes should be viewed in context, not isolation.

5. Reassessments and Tax Increases

Buyers should understand reassessment risk:

Some towns reassess regularly

Others go years between reassessments

A purchase at a high price can trigger future increases even if the current tax bill looks reasonable.

6. How Taxes Affect Affordability and Resale

Higher taxes impact:

Monthly affordability

Buyer pool size

Long-term resale appeal

Homes with disproportionate tax burdens often take longer to sell.

7. Appealing Property Taxes

Buyers can appeal assessments, but:

Timing is critical

Evidence matters

Success is not guaranteed

Appeals should be pursued strategically, not automatically.

8. Common Buyer Mistakes

Common tax-related errors include:

Ignoring reassessment risk

Comparing taxes across towns inaccurately

Assuming taxes won’t change

Education prevents costly surprises.

9. Final Thoughts

Property taxes are a permanent part of New Jersey homeownership. Buyers who understand them upfront make better decisions, budget more accurately, and avoid regret later.