How Commute Patterns Impact Chester County Home Prices

Summary

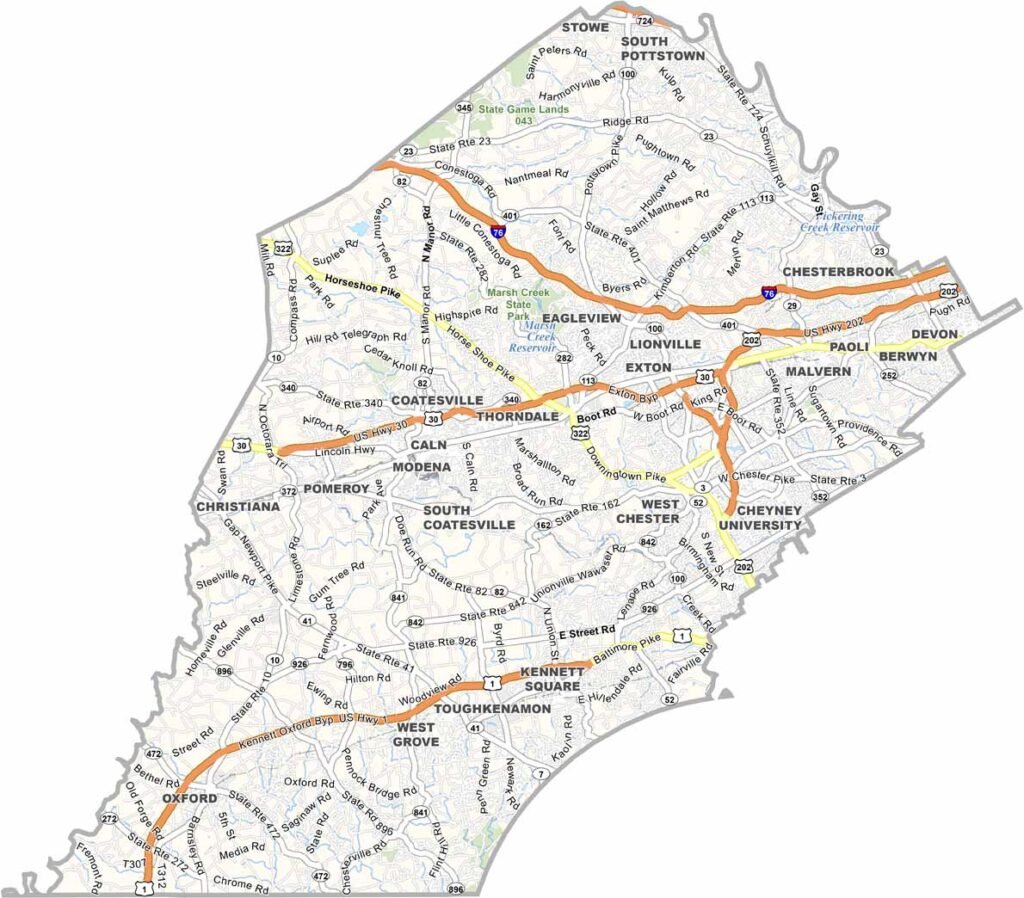

In Chester County, home prices are not determined by square footage alone—they are shaped by how easily (and how often) residents can commute. While remote and hybrid work have softened daily travel for many professionals, access to rail lines, major highways, and employment corridors continues to drive buyer demand in towns like Malvern, Paoli, Wayne, West Chester, Downingtown, Exton, and Phoenixville.

In 2026, commute patterns still influence pricing, days on market, and long-term resale strength across Chester County. This guide explains how transportation access, employer hubs, school districts, and lifestyle amenities combine to create value—and how buyers and sellers can use this knowledge strategically.

Table of Contents

Why Commute Still Matters in 2026

The SEPTA Rail Corridor Effect (Paoli/Thorndale Line)

Highway Access and the Route 202 Corridor

Reverse Commutes and Suburban Employment Growth

Hybrid Work: What Changed and What Didn’t

School District + Commute = Pricing Multiplier

Walkable Boroughs vs. Car-Dependent Subdivisions

Micro-Location: Street-Level Impact

What This Means for Buyers

What This Means for Sellers

Final Takeaways

1. Why Commute Still Matters in 2026

Although hybrid schedules are common, proximity to employment hubs still plays a central role in pricing. Buyers consider:

Travel time to Center City Philadelphia

Access to King of Prussia employment centers

Commuting options to Delaware corporate hubs

Connectivity to I-76, Route 202, and Route 30

Even if someone commutes only two or three days per week, reducing friction remains valuable. Homes that simplify logistics tend to attract stronger offers and hold value better during market slowdowns.

2. The SEPTA Rail Corridor Effect (Paoli/Thorndale Line)

Towns along the Paoli/Thorndale Regional Rail Line consistently demonstrate pricing resilience.

Key stations and towns:

Paoli

Malvern

Exton

Downingtown

Buyers value:

Direct access to Center City

Predictable commute times

Walkability to rail stations

Proximity to downtown amenities

For example:

Paoli and Malvern benefit from rail access combined with strong school districts like Tredyffrin-Easttown (T/E)and Great Valley.

Homes within walking distance of a station often command a measurable premium.

Transit proximity does not guarantee higher pricing—but it broadens the buyer pool, which supports liquidity.

3. Highway Access and the Route 202 Corridor

Not all commuters use rail.

The Route 202 corridor is one of Chester County’s most important pricing drivers. It connects:

Malvern and Paoli

King of Prussia

West Chester

Downingtown

Employment density near King of Prussia and corporate campuses along 202 create consistent demand in:

Malvern

Berwyn

Exton

Parts of West Chester

Access to I-76 and Route 100 also matters for buyers traveling toward:

Center City

The Main Line

Delaware County

Delaware State

Towns offering short highway access without feeling “on top of the road” often perform best.

4. Reverse Commutes and Suburban Employment Growth

Chester County is not just a bedroom community—it has significant employment nodes.

Corporate campuses, healthcare facilities, and regional employers in:

Malvern

Exton

West Chester

…have created reverse-commute demand.

Buyers working locally often prioritize:

Short drives

Access to shopping and dining hubs

Proximity to parks and recreational space

As suburban employment expands, demand spreads beyond rail-centric towns.

5. Hybrid Work: What Changed and What Didn’t

Hybrid work has reshaped priorities—but not eliminated commute influence.

What changed:

Buyers tolerate slightly longer commutes.

Larger homes and office space matter more.

Lifestyle amenities carry greater weight.

What didn’t change:

Easy access to highways and rail still drives confidence.

Towns with strong school districts remain competitive.

Walkability continues to command premiums.

For example, buyers may now accept living slightly farther from rail in Downingtown or West Chester if they gain more space—but they still value reasonable travel times.

6. School District + Commute = Pricing Multiplier

The strongest Chester County markets combine:

Strong school districts

Convenient commute access

Walkable or lifestyle-driven amenities

Examples:

Malvern (Great Valley SD + rail + Route 202)

Paoli (T/E SD + rail + proximity to Main Line)

West Chester Borough (West Chester Area SD + walkable downtown + Route access)

When commute convenience pairs with top-tier schools, pricing resilience strengthens significantly.

7. Walkable Boroughs vs. Car-Dependent Subdivisions

Lifestyle intersects with commute patterns.

Walkable boroughs:

West Chester Borough

Parts of Malvern

Portions of Phoenixville

Offer:

Restaurants, cafes, local shops

Community events

Vibrant downtown cores

Buyers often accept slightly longer commutes for lifestyle quality.

Car-dependent subdivisions:

Offer more space and newer construction

Often located further from rail

Appeal to families prioritizing square footage

Commute flexibility has made these neighborhoods more competitive than in purely commuter-driven eras.

8. Micro-Location: Street-Level Impact

Within the same town, commute convenience can vary dramatically:

Distance to rail station

Ease of turning onto major roads

Traffic congestion patterns

Noise from highways

A home five minutes closer to Route 202 or within walking distance of the Paoli station may command stronger offers than a similar home deeper in a subdivision.

This is where hyper-local analysis matters.

9. What This Means for Buyers

If you’re buying in Chester County:

Evaluate real commute times at actual travel hours.

Consider proximity to rail, highways, and employment hubs.

Balance commute convenience with lifestyle amenities.

Understand how school district strength amplifies pricing.

Don’t overreact to remote-work headlines—commute access still drives long-term demand.

10. What This Means for Sellers

If you’re selling:

Highlight proximity to rail stations and highways.

Emphasize realistic commute times in marketing materials.

Showcase walkability to downtown Malvern, West Chester, or Phoenixville if applicable.

Price strategically—strong commute positioning can compress days on market.

Buyers respond to clarity about convenience.

11. Final Takeaways

Commute patterns remain a foundational driver of Chester County home prices in 2026. The most resilient markets combine:

Strong school districts

Rail or highway accessibility

Walkable downtowns

Access to employment corridors

While interest rates and remote work influence behavior, commute convenience continues to shape value, demand, and resale performance.

Understanding these dynamics allows buyers and sellers to act strategically rather than reactively.

By Eric Kelley, Philadelphia Suburbs Realtor & Attorney