Chester County Real Estate Market Statistics by Township (PA)

Summary

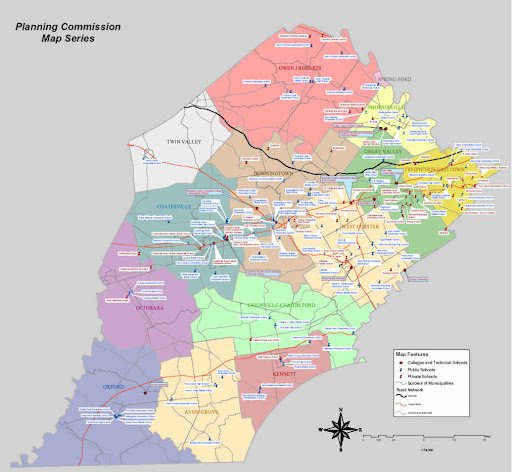

Chester County is not a single real estate market—it is a collection of distinct township-level micro-markets, each driven by its own mix of school districts, commute access, walkability, housing stock, and inventory constraints. In 2026, understanding market statistics at the township level—rather than relying on countywide averages—is critical for buyers and sellers who want to price accurately, negotiate intelligently, and avoid costly mistakes.

This guide explains how to interpret Chester County real estate market statistics by township, with practical insight into what the numbers typically mean in high-demand areas such as Tredyffrin, Easttown, Willistown, West Goshen, East Goshen, West Whiteland (Exton), Downingtown, Phoenixville, and Kennett Square.

Table of Contents

Why Township-Level Market Stats Matter

The Five Most Important Market Metrics to Track

Tredyffrin Township (Paoli / Chesterbrook Area)

Easttown Township (Devon / Berwyn)

Willistown Township (Malvern-Area Estate Markets)

East Goshen & West Goshen Townships (West Chester Area)

West Whiteland Township (Exton)

Downingtown Borough & Surrounding Townships

Phoenixville Borough & Schuylkill Township

Kennett Square Borough & Kennett Township

How Buyers Should Use Township Statistics

How Sellers Should Use Township Statistics

Final Takeaways

1. Why Township-Level Market Stats Matter

Countywide statistics hide important differences. A Chester County median sale price blends together:

Walkable boroughs

Rail-access communities

Estate-style rural townships

Newer subdivisions and older housing stock

Two homes just 10–15 minutes apart can behave like completely different markets depending on school district demand, commute access (Route 202, Route 30, SEPTA rail), and lifestyle amenities.

Serious buyers and sellers analyze data at the township level, not the county level.

2. The Five Most Important Market Metrics to Track

When evaluating any Chester County township, focus on:

Median Sale Price & Price per Square Foot

Useful only when comparing similar home types and price brackets.Days on Market (DOM)

A strong indicator of demand and pricing accuracy.List-to-Sale Price Ratio

Shows negotiating leverage—near or above 100% often indicates seller-leaning conditions.New Listings vs Closed Sales

Indicates whether inventory is tightening or building.Months of Inventory

The clearest market indicator:0–3 months: seller-leaning

3–5 months: balanced

5+ months: buyer-leaning

3. Tredyffrin Township (Paoli / Chesterbrook Area)

What drives demand:

Tredyffrin benefits from Main Line adjacency, Route 202 access, and strong school district reputation. Buyers prioritize long-term resale confidence.

How stats typically behave:

Inventory is often limited, and homes priced correctly—especially near rail or Chesterbrook—tend to sell quickly. DOM increases sharply for dated properties.

Lifestyle anchors:

Paoli rail station, Route 202 corridor, proximity to the broader Main Line.

4. Easttown Township (Devon / Berwyn)

What drives demand:

Easttown is defined by scarcity. Low housing turnover and consistent buyer demand create a tight market.

How stats typically behave:

Fewer listings, faster decisions, and a noticeable premium for renovated or move-in-ready homes.

Lifestyle anchors:

Proximity to Berwyn and Devon conveniences and the Main Line retail and dining corridor.

5. Willistown Township (Malvern-Area Estate Markets)

What drives demand:

Larger lots, privacy, and a blend of Main Line access with rural character.

How stats typically behave:

Sales data can appear volatile due to the presence of estate properties. Pricing accuracy is critical at higher price points.

Lifestyle anchors:

Malvern Borough dining and rail access, open space, equestrian culture.

6. East Goshen & West Goshen Townships (West Chester Area)

What drives demand:

Close proximity to West Chester Borough combined with established family neighborhoods.

How stats typically behave:

Steady demand, predictable DOM by price band, with strong performance for updated homes.

Lifestyle anchors:

West Chester Borough restaurants and events, nearby parks, everyday retail access.

7. West Whiteland Township (Exton)

What drives demand:

Exton functions as a regional convenience hub with rail, retail, and highway access.

How stats typically behave:

Wide variation in pricing and DOM due to diverse housing stock. Micro-location—traffic, noise, and proximity to amenities—matters significantly.

Lifestyle anchors:

Exton shopping and dining corridor, Paoli/Thorndale rail line.

8. Downingtown Borough & Surrounding Townships

What drives demand:

Borough walkability, rail access, and strong community identity.

How stats typically behave:

Walkable pockets near the borough core outperform farther-out subdivisions. Renovated homes near downtown compress DOM.

Lifestyle anchors:

Downingtown dining and brewery scene, including Victory Brewing Company, plus SEPTA access.

9. Phoenixville Borough & Schuylkill Township

What drives demand:

Phoenixville’s downtown lifestyle draws buyers who prioritize energy, dining, and walkability.

How stats typically behave:

Fast-moving segments near Bridge Street; more space and longer timelines in Schuylkill Township.

Lifestyle anchors:

Bridge Street restaurants, trails, and weekend events.

10. Kennett Square Borough & Kennett Township

What drives demand:

A unique destination market with charm, dining, and cultural appeal.

How stats typically behave:

Strong demand near the borough; wider variability in rural areas where inventory type can skew statistics.

Lifestyle anchors:

Longwood Gardens, nationally recognized dining such as Talula’s Table.

11. How Buyers Should Use Township Statistics

Buyers should use township data to identify:

Where competition is strongest

Where pricing sensitivity exists

Where inventory is quietly building

Where turnkey homes command the highest premium

The goal isn’t to find the lowest price—it’s to find the best value within a demand-supported township.

12. How Sellers Should Use Township Statistics

Sellers should use township stats to:

Price accurately in the first 10–14 days

Decide where prep and presentation matter most

Avoid chasing the market with reductions

In many Chester County townships, pricing strategy matters more than marketing volume.

13. Final Takeaways

Chester County real estate is defined by township-level dynamics. Buyers and sellers who rely on countywide averages often misread the market, while those who understand local statistics gain a meaningful advantage.

In 2026, success comes from precision—knowing how your specific township behaves, not just what the headline numbers say.

By Eric Kelley, Philadelphia Suburbs Realtor & Attorney