Bucks County Property Taxes Explained by Township

Summary

Property taxes are one of the most important—and most misunderstood—parts of buying a home in Bucks County, Pennsylvania. Two homes with the same price tag can have very different monthly carrying costs depending on the township/borough, the school district, and the property’s assessed value. In 2026, buyers (especially relocators from New Jersey, NYC, and DC) are paying closer attention to taxes because they directly affect affordability, resale confidence, and long-term ownership costs.

This guide explains how Bucks County property taxes work and provides a township-level framework you can use to compare areas like Newtown, Yardley, Doylestown, Warrington, and more—without getting lost in millage jargon.

Table of Contents

How Bucks County Property Taxes Actually Work

The Three Buckets That Make Up Your Tax Bill

Why “Township” Matters (Even Within the Same Zip Code)

Township-by-Township: What Buyers Should Expect

Neighborhood-Level “Tax Reality Checks” by Buyer Type

How to Estimate Your Taxes Before You Offer

Common Misconceptions (That Cost Buyers Money)

Final Takeaways for Bucks County Buyers in 2026

1. How Bucks County Property Taxes Actually Work

In Bucks County, your annual property tax bill is usually a combination of taxes from:

Your municipality (township or borough)

Your school district (often the biggest portion)

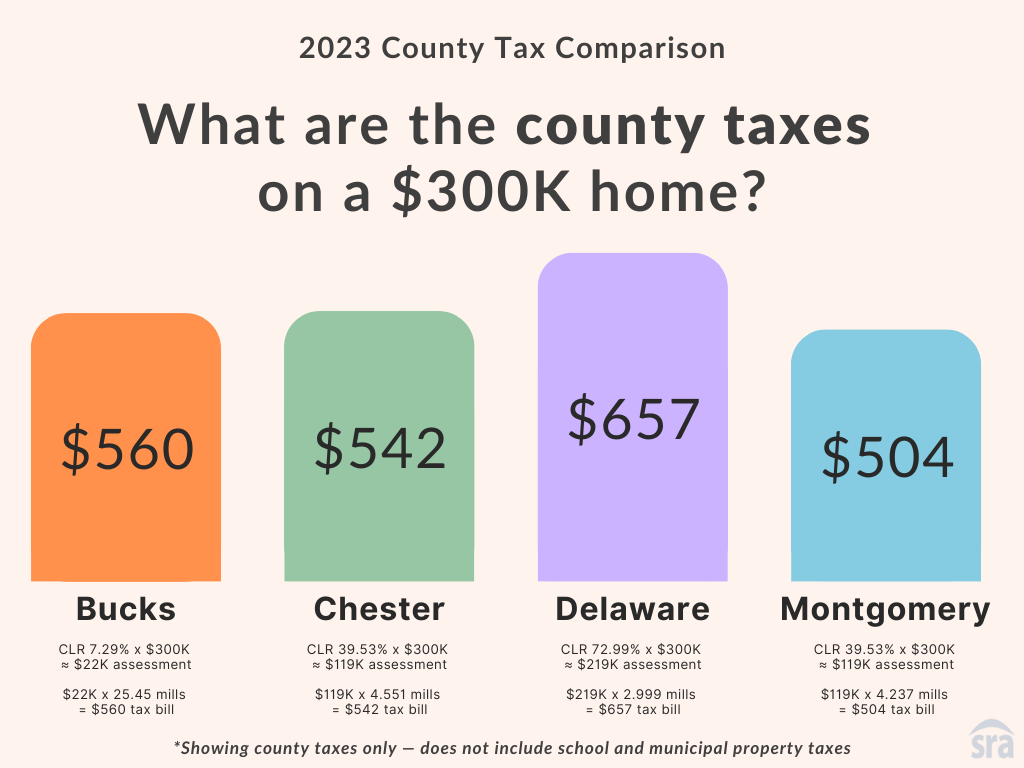

Bucks County

So when buyers say, “Taxes are high in Newtown” or “Taxes are lower in Warrington,” what they really mean is: the combined local + school + county tax picture differs—and it can differ a lot even across short distances.

The key point: Township borders and school district borders do not always align cleanly with “town names.” That’s why a street-by-street approach matters.

2. The Three Buckets That Make Up Your Tax Bill

Here’s the simplest way to understand taxes in Bucks County:

A) Assessed Value

Pennsylvania uses an assessed value system that does not always match current market value. Two homes that sell for the same price can carry different assessments based on history, improvements, and how reassessment has been applied over time.

B) Millage Rates

Each taxing authority applies a millage rate. You’ll often see separate line items for:

Township/borough

School district

County

C) School District Impact

For most buyers, the school district is the “hidden driver.” Strong districts often correlate with higher taxes—but also stronger long-term demand and resale confidence.

3. Why “Township” Matters (Even Within the Same Zip Code)

In Bucks County, the word “town” can be misleading. For example, “Doylestown” could mean:

Doylestown Borough (more walkable, denser, different tax profile)

Doylestown Township (more suburban, larger lots, different tax profile)

The same concept applies to:

Newtown Borough vs. Newtown Township

Yardley Borough vs. Lower Makefield Township

Langhorne Borough vs. Middletown Township

These distinctions are extremely important for monthly cost and resale positioning.

4. Township-by-Township: What Buyers Should Expect

Below is a buyer-useful township-level breakdown. This is not a promise of specific dollar amounts (tax bills are property-specific), but a practical way to compare and ask the right questions.

Newtown Township / Newtown Borough (Council Rock area)

Buyer profile: Families, Main Line/NYC relocators, move-up buyers

What drives taxes: School demand + premium location + high buyer competition

Neighborhood-level notes: Homes closer to walkable Newtown Borough amenities often command premiums, and taxes should be evaluated alongside lifestyle value.

What to watch: Some buyers overfocus on tax bills and ignore resale strength. In school-driven markets like Council Rock, demand tends to support long-term value.

Lower Makefield Township (Yardley / Pennsbury area)

Buyer profile: Commuters, families wanting stability, buyers who value neighborhood cohesion

Lifestyle anchors: Yardley’s downtown feel, river-town charm, parks, and community events

Tax reality: Often perceived as “high,” but many buyers accept it because Pennsbury schools and the Yardley lifestyle create durable demand.

What to watch: Confirm flood-related considerations near water-adjacent areas, which can affect insurance costs more than the tax bill itself.

Middletown Township (Langhorne / Core Creek area)

Buyer profile: First move-up, value seekers who still want strong access to amenities

Amenities: Core Creek Park is a major quality-of-life draw

Tax reality: A broad housing stock means wide variability—some neighborhoods feel like a bargain, others carry higher total cost due to assessment and school assignment.

What to watch: Compare taxes development-by-development; two nearby neighborhoods can diverge substantially.

Northampton Township (Richboro / Council Rock)

Buyer profile: Families prioritizing school reputation and suburban consistency

Why buyers choose it: Council Rock draw + strong neighborhood identity

Tax reality: Often competitive relative to the value buyers perceive—especially for those planning to own long-term.

What to watch: Homes along major roads or with functional layout issues may carry slower resale even within strong school zones—taxes won’t fix marketability.

Warrington Township / Warwick Township (Central Bucks)

Buyer profile: Families, buyers seeking newer subdivisions and convenience

Lifestyle: More “suburban network” than downtown-centric

Tax reality: Many homes are newer, which can mean higher assessments and higher bills than buyers expect.

What to watch: If you’re comparing Warrington to older-housing areas, remember: newer homes often bring higher taxes even if millage is similar.

Doylestown Borough vs. Doylestown Township (Central Bucks)

Buyer profile: Buyers who want charm + schools + culture

Downtown draw: Restaurants, shops, and cultural amenities create a real lifestyle premium

Tax reality: Borough vs township can differ meaningfully; borough walkability can be worth it, but you want to price taxes into monthly carry cost.

What to watch: Older borough homes may have renovation needs; your real monthly cost is taxes + maintenance + future improvement plans.

Upper Makefield Township (Washington Crossing / New Hope-adjacent)

Buyer profile: Luxury buyers, equestrian/estate preferences, privacy seekers

Lifestyle: Larger lots, prestige positioning, scenic feel

Tax reality: Larger properties often come with higher taxes simply due to assessment, not necessarily “higher rates.”

What to watch: When homes are priced at premium levels, resale timing can be slower—taxes should be evaluated as part of the total ownership profile.

New Hope / Solebury Township (New Hope lifestyle market)

Buyer profile: Lifestyle buyers, second-home buyers, creatives, NYC/Philly professionals

Lifestyle anchors: Shops, dining, river-town culture, weekend tourism energy

Tax reality: A unique submarket; buyers often pay for lifestyle and accept higher carrying costs.

What to watch: Some streets behave like entirely different markets; micro-location matters more here than almost anywhere else in Bucks.

5. Neighborhood-Level “Tax Reality Checks” by Buyer Type

If you’re a NYC/DC relocator

Don’t compare taxes in isolation. Compare:

Taxes + insurance + commute costs

School quality + resale confidence

Lifestyle value (walkable downtown vs. drive-only convenience)

If you’re a first move-up buyer

Watch out for the “new construction tax surprise.” Newer developments in Warrington/Warwick can have higher assessments than expected.

If you’re a luxury buyer

Taxes are rarely the deal-breaker—liquidity is. Buying the right micro-location is more important than shaving a few thousand per year off taxes.

6. How to Estimate Your Taxes Before You Offer

Before making an offer, you should ask for or verify:

The current tax bill (not a guess)

The property’s assessed value

The school district assignment

Whether there have been recent improvements that could affect assessment

Then calculate a realistic monthly carry cost with your lender, including escrow.

7. Common Misconceptions (That Cost Buyers Money)

“All of Doylestown has the same taxes.” Borough vs township matters.

“Lower taxes always mean better value.” Sometimes it means weaker demand or services.

“School district doesn’t matter if I don’t have kids.” It often matters for resale liquidity.

“I can estimate taxes from list price.” Not reliably in PA.

8. Final Takeaways for Bucks County Buyers in 2026

Bucks County property taxes are best understood through a township + school district lens, not broad county averages. The smartest buyers in 2026 compare total monthly carrying cost, evaluate school-driven demand, and choose micro-locations aligned with their lifestyle and resale goals.

If you’re buying in Bucks County, the right approach is not “find the lowest taxes.” It’s: find the best long-term fit at a total cost that makes sense.

By Eric Kelley, Philadelphia Suburbs Realtor & Attorney