Comparing Property Taxes: Delaware, Chester, Montgomery, & Bucks Counties

Table of Contents

- Introduction

- Why Property Taxes Matter

- How Taxes Differ by County

- County-by-County Breakdown

- How Taxes Affect Buying Power

- What Buyers Should Consider

- Final Thoughts

- Work With a Local Realtor

1. Introduction

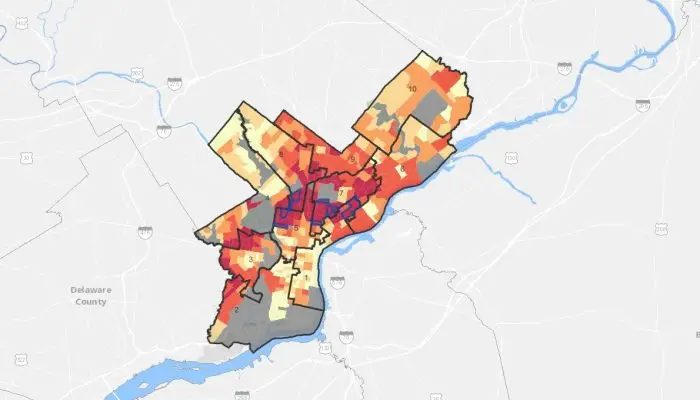

If you’re buying a home in the Philadelphia suburbs, property taxes play a major role in your monthly payment and long-term budget. Taxes vary significantly between Delaware, Chester, Montgomery, and Bucks Counties — so choosing the right area can save you thousands of dollars over the life of your mortgage.

2. Why Property Taxes Matter

Taxes impact:

- Monthly mortgage payments

- Affordability

- School funding

- Long-term resale value

- Investment returns

Understanding these differences helps buyers choose the right county for their needs.

3. How Taxes Differ by County

While Pennsylvania generally has moderate property taxes compared to New York or New Jersey, each county has its own range and structure. Taxes are closely tied to school district funding — meaning areas with top districts tend to have higher tax rates.

4. County-by-County Breakdown

Delaware County

- Higher taxes relative to home prices

- Known for excellent schools in Radnor, Wallingford-Swarthmore, and Haverford

- Boroughs like Media and Swarthmore offer walkability but higher tax bills

Chester County

- Balanced taxes with strong value

- Popular districts include West Chester, Unionville-Chadds Ford, and Downingtown

- Large geographic diversity → wide range of tax rates

Montgomery County

- Strong schools but taxes vary widely

- Lower Merion & Cheltenham tend to be higher, while towns like Collegeville and Souderton are lower

- Many buyers balance higher taxes with Main Line convenience

Bucks County

- Moderate taxes with high-rated schools

- Council Rock & Central Bucks have strong demand

- Good value for families seeking space

5. How Taxes Affect Buying Power

Higher property taxes reduce how much home you can afford.

Example:

A $7,000 annual tax bill vs. a $12,000 bill can shift buying power by tens of thousands of dollars.

This is why many buyers widen their search to include lower-tax areas in Chester or Bucks County.

6. What Buyers Should Consider

- Total monthly payment

- School district priorities

- Commute

- Resale value

- Long-term affordability

7. Final Thoughts

Taxes vary greatly by county, but each offers strong school districts and desirable communities. Buyers should evaluate taxes in combination with lifestyle needs and market conditions.

8. Work With a Local Realtor

Need help comparing taxes across the suburbs? I can guide you through the numbers and neighborhood trade-offs.