How Inventory Levels Are Changing Across the Philly Suburbs in 2026:

A Town-by-Town Analysis

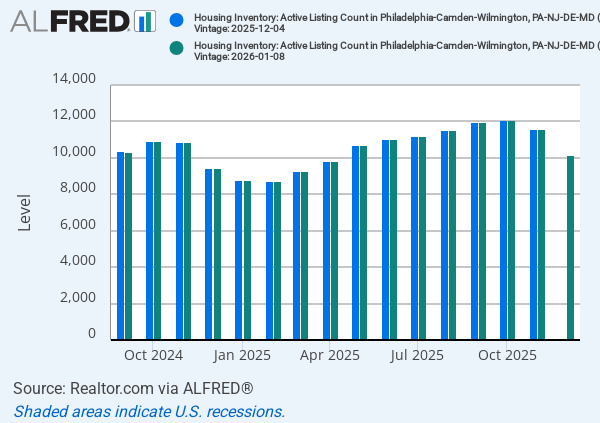

Housing inventory is the single most important variable shaping the Philadelphia suburban real estate market in 2026. More than interest rates, more than national headlines, and more than buyer sentiment, inventory levels determine leverage—who has it, when, and where.

Across the Philly suburbs, inventory is not moving in one direction. Some towns are seeing modest relief, others remain historically tight, and a few micro-markets are behaving very differently than their neighbors just a few miles away. For buyers and sellers alike, understanding these differences is the key to making a smart, strategic move.

This post breaks down how inventory levels are changing across Chester County, the Main Line, Bucks County, Camden County (NJ), and the Southern New Jersey Shore, and what those changes actually mean on the ground.

Table of Contents

Why Inventory Matters More Than Headlines

How Inventory Is Measured: Months of Supply Explained

Chester County Inventory Trends in 2026

Main Line Inventory: Why Supply Remains Constrained

Bucks County Inventory by Town: Where Supply Is Tightest

Camden County, NJ Inventory Trends (Haddonfield, Moorestown, Cherry Hill, Medford)

Southern New Jersey Shore Inventory: Seasonal but Scarce

How Inventory Differs by Price Point in the Philly Suburbs

What Changing Inventory Means for Buyers in 2026

What Changing Inventory Means for Sellers in 2026

Final Takeaways: How to Use Inventory Data Strategically

Why Inventory Matters More Than Headlines

Inventory is best measured in months of supply—how long it would take to sell all active listings at the current pace of sales. As a general rule:

0–3 months = strong seller’s market

3–5 months = balanced market

6+ months = buyer’s market

Most Philly suburbs are still operating below balanced levels in 2026, but the degree of scarcity varies significantly by location, price point, and property type.

Chester County: Gradual Relief, Still Selective

Chester County has experienced one of the more noticeable inventory increases in the region—but context matters. The increase has been incremental, not dramatic.

Towns like West Chester, Downingtown, Malvern, and Phoenixville have seen more listings come to market compared to the lows of 2022–2023. This is due in part to:

Move-up sellers finally re-entering the market

Newer construction in select corridors

Slightly longer days on market for overpriced homes

That said, well-priced homes in strong school districts (West Chester Area, Downingtown Area, Great Valley) still move quickly. Inventory gains here have improved buyer choice, but not buyer dominance.

What it means:

Buyers have more room to negotiate terms (repairs, timing), but pricing discipline still matters. Sellers must price accurately from day one.

The Main Line: Inventory Remains Structurally Constrained

On the Main Line, inventory remains among the tightest in the entire Philadelphia region. Towns like Ardmore, Bryn Mawr, Wayne, Haverford, and Villanova continue to face structural supply limitations.

Why inventory stays low:

Limited land for new development

High homeowner tenure (people stay longer)

Strong school districts anchoring demand

Consistent interest from luxury and relocating buyers

While some listings are staying on the market slightly longer in 2026, this is more a reflection of buyer selectivity than true oversupply.

What it means:

For buyers, patience and preparation matter more than timing. For sellers, correctly priced homes—especially in the $800k–$1.5M range—still command attention.

Bucks County: Inventory Varies Sharply by Town

Bucks County shows some of the widest inventory variation in the suburbs.

Newtown, Yardley, and Richboro remain tight, particularly in neighborhoods tied to top school districts like Council Rock and Pennsbury.

Doylestown has seen slightly more inventory, especially in higher price brackets and older housing stock.

Semi-rural and edge-of-county areas have experienced more noticeable slowdowns.

In 2026, buyers are being more selective about layout, condition, and location, which has caused a visible split: turnkey homes sell quickly, while others linger.

What it means:

Inventory alone doesn’t tell the story. Buyers should focus on micro-locations. Sellers should not assume county-wide demand applies equally to every neighborhood.

Camden County, NJ: Stable but Highly Segmented

In Camden County—particularly Haddonfield, Moorestown, Cherry Hill, and Medford—inventory levels remain relatively stable, but highly segmented.

Haddonfield and Moorestown continue to see very limited supply, driven by strong schools and walkable downtowns.

Cherry Hill shows more inventory, but varies dramatically by section.

Medford offers more space and inventory, but homes still need to be priced with tax sensitivity in mind.

New Jersey’s higher property taxes tend to moderate speculative listing behavior, which has helped keep inventory from swinging wildly.

What it means:

Buyers need township-level analysis, not county-level assumptions. Sellers must account for tax-adjusted affordability when pricing.

Southern New Jersey Shore: Seasonal, But Still Supply-Constrained

Inventory along the Southern Jersey Shore—Avalon, Stone Harbor, Sea Isle City, Wildwood, and Cape May—remains constrained in 2026, especially for high-quality properties.

Key dynamics:

Many owners are long-term holders, not forced sellers

New construction is limited by zoning and geography

Demand remains strong for well-located homes near beaches and town centers

Seasonality still matters, but inventory spikes are smaller than in past cycles.

What it means:

Buyers looking for shore properties must be decisive. Sellers benefit from scarcity, but condition and rental performance expectations are higher than ever.

Price Point Matters More Than Ever

Across all suburbs, inventory behaves differently by price tier:

Entry and mid-range homes remain scarce

Luxury inventory (especially $1.2M+) has grown modestly

Overpricing is punished more quickly in 2026

This has created a more rational market—still competitive, but less emotional.

Strategic Takeaways for Buyers and Sellers

For buyers:

Inventory relief does not mean a buyer’s market

Leverage comes from preparation, not waiting

Town-by-town analysis is essential

For sellers:

Pricing strategy matters more than timing

Inventory competition is hyper-local

Buyers are still active—but more analytical

Final Thoughts

Inventory across the Philly suburbs in 2026 is best described as uneven, localized, and strategic. Broad headlines miss the nuance that actually drives outcomes.

The buyers and sellers who succeed are those who understand their specific market—not the national narrative.

If you’re considering buying or selling in the Philadelphia suburbs, the most valuable first step is understanding your town’s inventory reality, not the regional average.

By Eric Kelley, Philadelphia Suburbs Realtor & Attorney