How Interest Rate Changes Actually Affect Home Prices

(Not the Way You Think)

Summary

When interest rates rise or fall, headlines often predict dramatic and immediate changes in home prices. Buyers panic. Sellers rush to list. Commentators declare the market “about to crash” or “about to surge.”

In reality, interest rates influence housing markets far more subtly — and unevenly — than most people expect.

In places like the Philadelphia suburbs, rate changes don’t simply push prices up or down. They reshape buyer behavior, shift demand between segments, and widen the gap between desirable and marginal homes.

This article explains how interest rate changes actually affect home prices, why the relationship isn’t linear, and what buyers and sellers should focus on instead of headlines.

Table of Contents

The Common Myth About Rates and Prices

What Interest Rates Really Change: Monthly Payments

Why Prices Don’t Move One-for-One With Rates

The Payment Ceiling: Where Rates Do Matter

Segment Shifts: Who Gets Hurt and Who Doesn’t

Inventory, Not Rates, Often Sets Prices

Why Desirable Homes Still Sell in High-Rate Markets

Buyer Psychology vs. Math

How Sellers Should Price in a Rate-Shift Environment

The Strategic Takeaway

1. The Common Myth About Rates and Prices

The most common assumption sounds logical but is wrong:

“If interest rates go up, home prices must come down.”

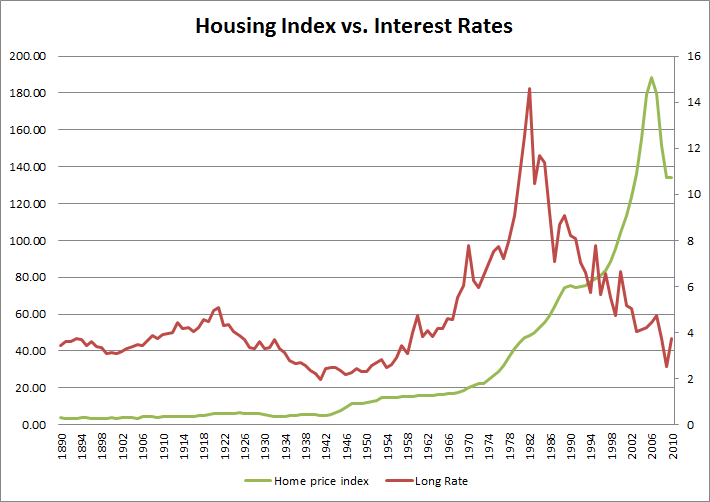

If that were true, housing markets would move in lockstep with rates. They don’t.

Historically, periods of rising rates have included:

Strong price growth

Flat prices

Slowing appreciation

Short-term pullbacks

Rates matter — but they are one variable among many, not a master switch.

2. What Interest Rates Really Change: Monthly Payments

Interest rates don’t directly change home prices. They change monthly affordability.

A higher rate means:

Higher monthly payment for the same purchase price

Tighter qualification thresholds

Increased sensitivity to small price differences

Buyers don’t ask, “What’s the house worth?”

They ask, “Can I live with this payment?”

That distinction is critical.

3. Why Prices Don’t Move One-for-One With Rates

If rates alone determined prices, every rate spike would trigger a crash. That doesn’t happen because:

Many sellers don’t need to sell

Existing homeowners are often locked into low-rate mortgages

Supply remains constrained in many suburbs

Buyers adjust expectations before sellers adjust prices

Instead of prices collapsing, what usually happens first is volume declines — fewer transactions, not lower prices.

4. The Payment Ceiling: Where Rates Do Matter

Rates matter most at the edges of affordability.

When rates rise:

Entry-level buyers feel it first

Stretch buyers fall out of the market

Price-sensitive segments slow

But higher-end, equity-rich, or dual-income buyers often:

Absorb the change

Adjust purchase criteria

Shift neighborhoods rather than exit the market

This is why rate hikes tend to compress the middle, not flatten the entire market.

5. Segment Shifts: Who Gets Hurt and Who Doesn’t

In the Philly suburbs, rate changes don’t affect all homes equally.

More vulnerable segments:

Marginal locations

Overpriced listings

Homes requiring significant work

Suburban sprawl without lifestyle upside

More resilient segments:

Strong school districts

Walkable neighborhoods

Scarce housing types

Homes with efficient layouts and good light

Rates don’t punish markets evenly — they reward selectivity.

6. Inventory, Not Rates, Often Sets Prices

One of the most overlooked dynamics is inventory.

When rates rise:

Fewer homeowners list (they don’t want to give up low rates)

Supply tightens

Buyers compete over fewer homes

This can support prices even as affordability declines.

In many Main Line, Chester County, and Bucks County micro-markets, limited inventory has mattered more than rate fluctuations.

Rates influence demand. Inventory controls outcomes.

7. Why Desirable Homes Still Sell in High-Rate Markets

In higher-rate environments, buyers don’t disappear — they become choosier.

Well-priced homes that offer:

Strong location

Functional layouts

Minimal deferred maintenance

Clear lifestyle value

still sell — often quickly.

What changes is tolerance. Buyers stop “settling” and start comparing harder.

This is why rising rates often expose overpricing rather than eliminate demand.

8. Buyer Psychology vs. Math

Math explains affordability. Psychology explains behavior.

When rates rise:

Buyers slow down

Fear headlines

Second-guess timing

Feel less urgency

This psychological drag can temporarily cool markets even when fundamentals remain strong.

Conversely, falling rates can:

Create urgency

Increase competition

Push buyers to act faster

But psychology fades. Fundamentals endure.

9. How Sellers Should Price in a Rate-Shift Environment

Sellers often make two mistakes when rates move:

Ignoring the impact entirely

Overreacting to headlines

Smart sellers:

Focus on current buyer alternatives

Price for today’s payment reality

Recognize that “aspirational” pricing works less often

Understand that condition and presentation matter more when buyers are cautious

Rates don’t eliminate value — they raise the bar.

10. The Strategic Takeaway

Interest rates influence housing markets — but not the way headlines suggest.

They:

Change monthly payments

Shift buyer psychology

Reduce tolerance for compromise

Increase segmentation

They do not automatically cause price collapses or booms.

In the Philly suburbs, outcomes are driven less by rates alone and more by:

Inventory constraints

School districts

Neighborhood desirability

Home quality and layout

Understanding that distinction helps buyers avoid paralysis and helps sellers avoid mispricing.

Closing Thought

Interest rates are a lens, not a verdict.

They shape how buyers think and how sellers must compete — but they don’t override the fundamentals that make certain homes desirable year after year.

The smartest buyers and sellers don’t chase rate predictions.

They focus on fit, fundamentals, and long-term positioning.

By Eric Kelley, Philadelphia Suburbs Realtor & Attorney