Is Now a Good Time to Buy a House in the Philadelphia Suburbs?

A Data-Driven 2026 Outlook

Summary

Many buyers across the Philadelphia suburbs are stuck in the same place:

They want to buy, but they’re afraid they’ll regret it.

High mortgage rates. Headlines about a slowdown. Friends telling them to wait.

But the real question isn’t whether today’s market is “good” or “bad.”

The question is whether waiting actually improves your long-term financial position.

This article breaks down what’s really happening across Chester County, the Main Line, and Bucks County — and why, for many buyers, 2026 may quietly be one of the best buying windows we’ve seen in years.

Table of Contents

The Market Has Shifted — But Not the Way People Think

What Mortgage Rates Are Really Doing to Prices

Inventory, Price Cuts, and Buyer Leverage

Why the Philly Suburbs Behave Differently Than National Housing

The Math of Waiting vs Buying

Who Should Buy in 2026 — And Who Shouldn’t

The Strategic Buyer’s Playbook

1. The Market Has Shifted — But Not the Way People Think

Most people think the housing market moves in simple cycles:

Boom

Bust

Recovery

But the Philadelphia suburbs don’t follow that pattern cleanly.

What has changed is not demand — it’s who can qualify.

Between 2020 and 2022:

Buyers were borrowing at 3%

Payments were cheap

Prices exploded

Between 2023 and 2026:

Buyers are borrowing at 6–7%

Monthly payments are much higher

Prices have flattened, not collapsed

That means buyers today face higher payments but more negotiating power.

This is the core opportunity most people miss.

2. What Mortgage Rates Are Really Doing to Prices

Every 1% increase in mortgage rates cuts buying power by roughly 10%.

That means:

A buyer who could afford $800,000 at 3% can only afford about $600,000–$650,000 at today’s rates.

Sellers can’t ignore that reality.

Across the Main Line, West Chester, and Bucks County, we are seeing:

More price reductions

Longer days on market

Fewer bidding wars

That is not a crash.

That is re-pricing to match affordability.

For buyers, this creates something rare:

Less competition without a flood of distressed sales.

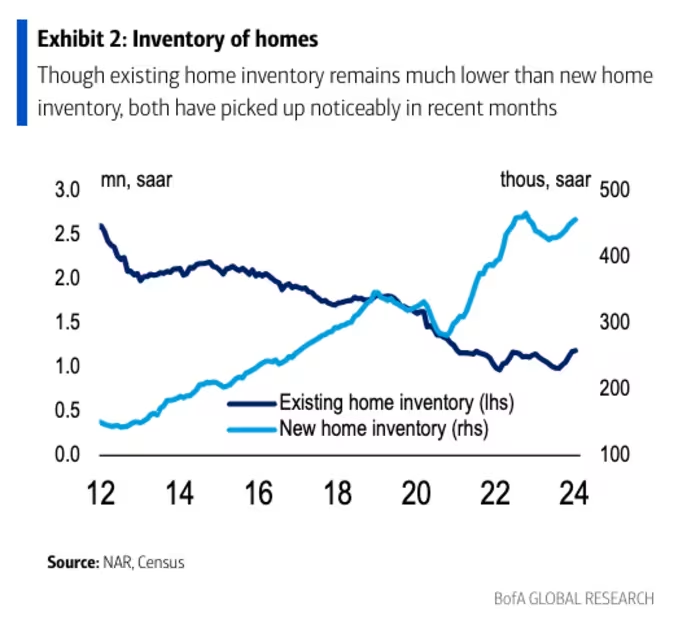

3. Inventory, Price Cuts, and Buyer Leverage

In today’s Philly-suburbs market, you will notice something important:

Homes are still selling — just not instantly.

That gives buyers:

Time to inspect

Time to negotiate

Time to ask for credits

Time to walk away

In 2021, you had none of that.

Sellers who want to move are now:

Paying closing costs

Buying down rates

Accepting inspection credits

Cutting prices

Those concessions often matter more than a lower headline price.

4. Why the Philly Suburbs Behave Differently Than National Housing

Markets like Phoenix, Austin, and parts of Florida are seeing real price drops.

The Philadelphia suburbs are different because:

Job centers are stable

School districts anchor values

There is limited buildable land

Inventory never fully recovered

Places like Lower Merion, Radnor, Tredyffrin-Easttown, Unionville, and Central Bucks don’t crash easily.

They stagnate — then resume rising.

That is exactly the kind of market buyers should want.

5. The Math of Waiting vs Buying

Here’s the uncomfortable truth:

If you wait for rates to drop, prices will rise.

Why?

Because:

Millions of buyers are on the sidelines

Lower rates instantly bring them back

Inventory will still be limited

So buyers who wait for 5% rates will likely face:

Higher home prices

More competition

Fewer concessions

Buying now lets you:

Negotiate price

Lock in concessions

Refinance later

You can change your rate.

You cannot change what you paid for the house.

6. Who Should Buy in 2026 — And Who Shouldn’t

You should strongly consider buying if:

You plan to stay 5+ years

You want stability

You can comfortably afford today’s payment

You value negotiating power

You should wait if:

You may move soon

Your job is unstable

You need perfect market timing to make the numbers work

This is not about guessing the bottom.

It is about owning in a supply-constrained, high-demand region.

7. The Strategic Buyer’s Playbook

The smartest buyers in the Philly suburbs right now are doing three things:

Buying homes with negotiating leverage

Using seller credits and rate buy-downs

Planning to refinance when rates fall

They are not trying to time the market.

They are trying to out-position everyone else.

That’s how real estate wealth is built.

By Eric Kelley, Philadelphia Suburbs Realtor & Attorney